Irs Loss From Rental Property Income

Becoming a landlord presents incredible opportunities for stable passive income. However, on top of the general uncertainty brought forth by a pandemic, renting out property also presents new financial and legal obligations, including taxes. There are several nuances to taxation of rental income, especially since there are differences between how the IRS treats real estate professionals renting out a property compared to those who simply receive supplemental income from rental activity.

- As a result, your total expenses exceed your rental income from the property by $150,000, giving rise to a tax loss in that amount. On your tax return, you reduce your $600,000 of doctor income.

- For example, if your adjusted gross income is $125,000, you can write off $12,500 in rental losses in the year of the loss. If you are an active participant and your adjusted gross income is $150,000 or more, y ou can write off no rental losses on your tax return in the year of the loss.

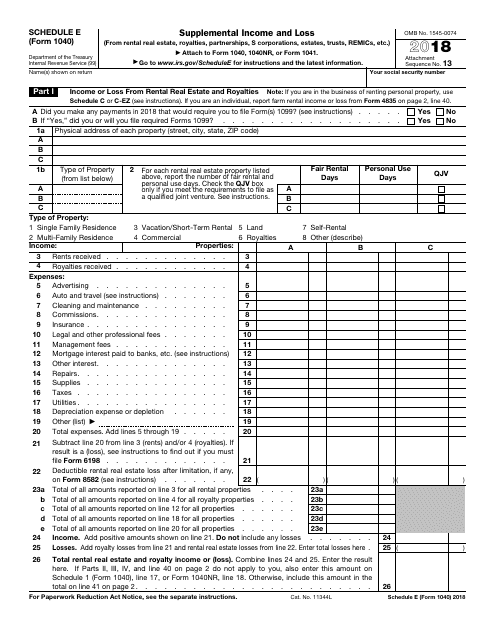

Income or Loss From Rental Real Estate and Royalties. Note: If you are in the business of renting personal property, use. See instructions. If you are an individual, report farm rental income or loss.

To get your total loss amount, you’ll subtract the amount your property sold for from that tax basis. So, if you bought your rental at $300,000 and made $10,000 in upgrades, you’ll have a tax basis. The Government Accountability Office reported that 53% of taxpayers with rental real estate misreport when they file their tax returns. That means many property owners overestimated real estate tax loss. The bottom line is that owning rental real estate is now an audit flag. These inflated tax losses cost the Treasury over $12 billion.

Here is what you need to know when it comes to filing rental income taxes in the age of COVID-19.

Questions about the coronavirus pandemic?

Visit the Coronavirus Legal Center and ask a lawyer today.

What COVID-19 tax relief is available for landlords?

For those who haven’t already filed, one big change is that the federal tax deadline for the 2019 tax year and the deadline for Q1 and Q2 estimated tax payments for 2020 have been extended to July 15th. The deadline for making individual retirement account (IRA) and health savings account (HSA) contributions for the 2019 tax year has also been moved to July 15th.

Outside of federal and state deadline changes, landlords should know about the following COVID-19 tax relief options:

Net operating losses carried back 5 years

The limitations on net operating losses have expanded so that you can apply your 2018, 2019, and 2020 net operating losses as far back as five years from when the loss occurred. For example, if you are suffering a loss in 2020 as a result of COVID-19, you can deduct it from taxable income as far back as 2015 to receive a tax credit.

Business interest expense deductions

The amount of loan interest that your business can deduct for 2019 and 2020 has increased from 30% to 50% of taxable income.

Qualified improvements

Businesses may also be able to write-off costs from improving their facilities immediately rather than having to depreciate them over time.

Emergency refund on corporate alternative minimum tax (AMT) credit

If you made AMT tax payments in 2020, you can claim a refund this year rather than waiting until the end of 2021.

If you are an employer, there is even more government relief available. A CPA or accountant can help you determine what tax credits and deductions are best for your situation.

Do I need to report and pay taxes on income from rental activity?

Generally speaking, if you are making money from operating a rental property, yes, you need to report and pay taxes on your income. Rental activity creates taxable income in a majority of cases. The only exception to this rule is if you rent out your primary residence, such as renting out a bedroom on a homestay website for less than 15 days during the tax year. No income is required to be reported in that case.

However, if you rent out your primary residence for longer than 15 days or have a vacation or investment property, you must report and pay tax on the net rental income. In most cases, rental income is considered investment income and it doesn’t trigger self-employment tax like a “side hustle”. However, if you are a real estate professional or looking to make rental activity a full-time gig, you may need to pay self-employment tax in addition to income tax. In some cases, you may be able to avoid this tax by forming a corporation or LLC. Talk to an accountant or a tax lawyer to understand the potential tax benefits or obligations related to your specific situation.

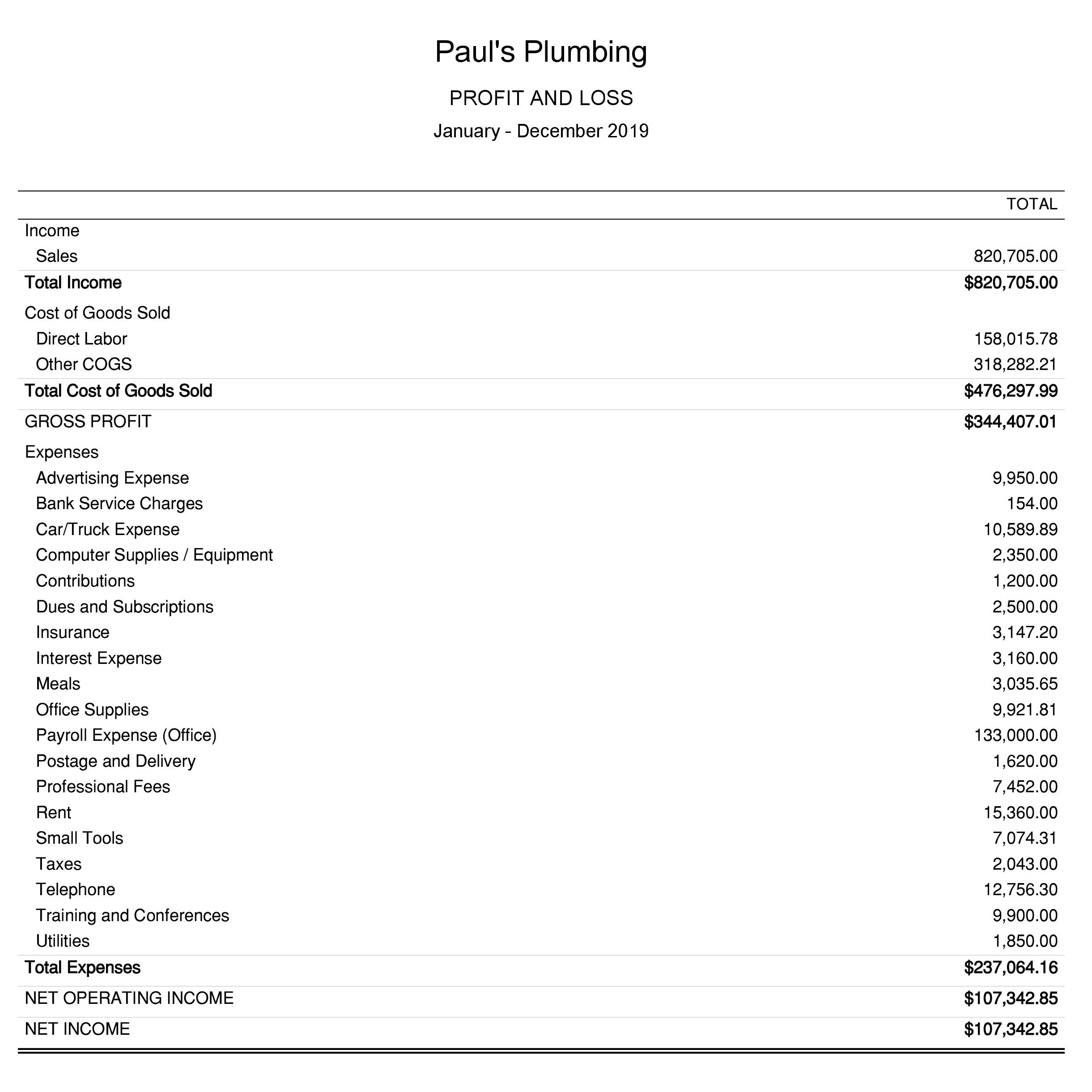

What types of expenses can I deduct as a landlord?

You can deduct expenses associated with rental activity if they are required to maintain the property, find a tenant, solve disputes, comply with the law, and other aspects of collecting rent and keeping your investment safe. The following items are deductible:

- Advertising your rental through property listings, websites, and other methods

- Legal and professional fees

- Property management fees

- Insurance

- Mortgage interest and real estate taxes

- HOA/condo board maintenance fees, if a condo property

- Repair and maintenance labor

- Purchase, installation, and maintenance of appliances and furniture

- Supplies used to get the property in move-in condition

- Legal and professional fees related to the lease or tenant disputes

- Collection agency fees

- State and local taxes on rental activity

- Utilities

If the property is unoccupied and it takes longer to get a tenant than you anticipated, you cannot deduct the rent that you would have received. You only report the rent that you eventually do receive, but you can deduct the marketing expenses related to attempts to obtain tenants. You can also deduct the operating and maintenance expenses in the time that the property was vacant but available for rent.

If the property does not meet building codes or a complaint is filed against you and the state or city takes action, you cannot deduct any fines or penalties. Only fees paid to attorneys, accountants, and other compliance professionals are deductible, along with local taxes and the labor costs involved in maintaining and improving the property

If my rental activity results in a loss, can I deduct it?

Most small landlords have a limit on the amount of rental loss that you are allowed to deduct. There are specific rules for losses from passive rental activity if you are not a full-time real estate professional such as a realtor or property manager.

Additionally, there are limits on your rental loss if you are renting out your primary residence (or put any other property to personal use).

Do landlords have to issue 1099 forms to contractors?

Form 1099-MISC is used to report payments made to contractors as part of business during the tax year. Payments can include fees for one-time services such as fixing a burst pipe to ongoing fees like lawn care or housekeeping for your rental units. If you paid the contractor more than $600, you may need to file a 1099-MISC. Generally speaking, if you made payments to corporations, paid using a payment processor like PayPal, or hired the contractor through a third-party platform, you do not have to file 1099s for those payments. If you have hired a property management company, the property manager may handle the 1099s for you, but it is important to confirm.

If you are unsure about filing a 1099, a tax lawyer or accountant can help.

What tax deadlines do I have as a landlord?

Tax deadlines for 2020 have been adjusted due to COVID-19, but generally speaking your due dates will vary depending on your business structure. Here are a few key dates to know for next year:

January 31, 2021

- Form 1099-MISC

March 15, 2021

- Form 1065 (Multi-member LLC, LLP or partnership)

- Form 1120-S (S-Corporation)

April 15, 2021

- Form 1040 (Individual tax return, including income from a single-member LLC or unincorporated business)

- Form 1120 (C-Corporation)

There may also be additional state and local deadlines for rental taxes, as well as self-employment taxes and quarterly estimated tax payments if you are a full-time self-employed real estate professional. A CPA or accountant can help you determine all of the deadlines and forms that apply to your specific situation.

Get help when you need it

2020 has been a challenging year for many landlords, and filing taxes for this year inevitably may raise new questions that you’ve never had to consider. If you have questions about the coronavirus pandemic and how it affects your taxes, talk to an accountant for guidance, or visit the Coronavirus Legal Center for Business and ask a lawyer any legal question for free.

Economic fallout from the COVID-19 crisis will cause many rental real estate properties to run up tax losses in 2020 — and possibly beyond. Here’s a summary of important federal income tax rules for such losses.

What You Can Write Off

Rental property owners can deduct mortgage interest and real estate taxes. They can also write off all standard operating expenses that go along with owning rental property. Examples include:

- Utilities

- Insurance

- Repairs and maintenance

- Care and maintenance of outdoor areas

For many rental property owners, the tax kicker is the depreciation deduction. That is, the cost of a rental building (not the land) can be depreciated over 27.5 years for a residential building and over 39 years for a commercial building — even while the property increases in value over time. Depreciation write-offs can deliver significant tax savings, especially if you own several properties.

For example, Ann owns an apartment building that cost $750,000, not including the land. Her annual depreciation deduction is $27,273 ($750,000 divided by 27.5 years). Each year, that deduction can be used to shelter up to $27,273 of positive cash flow from income taxes.

Rental Properties with Positive Taxable Income

Despite the COVID-19 crisis, some properties will generate positive taxable income, instead of losses, in 2020 and beyond. This happens when rents surpass deductible expenses. (See main article.)

Of course, you must report those profits as passive taxable income. But, if you’ve accumulated suspended passive losses from earlier years, you now get to use them to offset your passive income.

Another upside is that taxable income from rental real estate isn’t subject to self-employment (SE) tax. The SE tax, which can be up to 15.3%, applies to most other unincorporated profit-making ventures.

However, passive income from rental real estate owned by higher-income individuals may be hit with the 3.8% net investment income tax (NIIT). Gains from selling properties also may be subject to the NIIT. Consult your tax advisor for details.

QIP Correction for Commercial Property Owners

The Coronavirus Aid, Relief, and Economic Security (CARES) Act includes a retroactive correction to the statutory language of the Tax Cuts and Jobs Act (TCJA). The correction allows much faster depreciation for commercial real estate qualified improvement property (QIP) that’s placed in service in 2018 through 2022.

QIP is defined as an improvement to an interior portion of a nonresidential building that’s placed in service after the building was placed in service. However, it doesn’t include any expenditures attributable to:

- Enlarging the building,

- Any elevator or escalator, or

- The building’s internal structural framework.

Thanks to the CARES Act correction, you can write off the entire cost of QIP in the first year it’s placed in service, because it now qualifies for 100% first-year bonus depreciation. Alternatively, you can depreciate QIP over 15 years using the straight-line method.

Important: The CARES Act correction retroactively applies to QIP placed in service in 2018 and 2019. Before the correction, QIP placed in service in those years generally had to be depreciated over 39 years.

Expanded Section 179 Deductions

For eligible property placed in service in tax years beginning after 2017, the TCJA increases the maximum Section 179 deduction to $1 million, with annual inflation adjustments. The inflation-adjusted maximum for tax years beginning in 2020 is $1.04 million. The Sec. 179 deduction privilege allows you to write off the entire cost of eligible property in the first year it’s placed in service.

The TCJA also expanded the definition of eligible property to include expenditures for:

- Nonresidential building roofs

- HVAC equipment

- Fire protection and alarm systems

- Security systems

Finally, the TCJA further expands the definition of eligible property to include depreciable tangible personal property used predominantly to furnish lodging. Examples of such property include beds, other furniture and appliances used in the living quarters of a lodging facility (such as an apartment building).

Complicated PAL Rules

Most new properties operate at a loss while they’re trying to find tenants. Losses are also common when the economy falters, causing tenants to miss rent payments and vacancy rates to increase. Rental losses can complicate your tax situation, especially if the so-called passive activity loss (PAL) rules come into play.

Losses from rental properties will usually be classified as passive losses. In general, the PAL rules allow you to deduct passive losses only to the extent that you have passive income from other sources, such as positive income from other rental properties or gains from selling them. Passive losses in excess of passive income are suspended until you either 1) have more passive income, or 2) sell the property that produced the losses.

As a result, the PAL rules can postpone any tax benefit from rental property losses, sometimes for many years. Fortunately, there are several exceptions that can allow you to deduct rental property losses sooner rather than later. Your tax pro can explain the exceptions and help you plan to become eligible, if possible.

Another Loss Disallowance Rule

Irs Forms For Rental Income

The TCJA established another hurdle to clear to currently deduct your rental property losses: For tax years beginning in 2018 through 2025, you can’t deduct an “excess business loss” in the current year. This term refers to a loss that exceeds $250,000 or $500,000 for a married joint-filing couple.

Under the TCJA, any excess business loss is carried over to the following tax year and can be deducted under the rules for net operating loss (NOL) carryforwards. This loss disallowance rule applies after applying the PAL rules. So, if the PAL rules disallow your rental losses, this rule doesn’t matter.

Irs Rental Income Worksheet

Important: The CARES Act suspends the excess business loss disallowance rule for losses that arise in tax years beginning in 2018 through 2020.

Net Operating Loss Deductions

If your rental property losses clear both the PAL and excess business loss hurdles, those losses can be used to offset taxable income from other sources. If losses for the year exceed income from other sources, you may have an NOL for the year.

Important: The CARES Act allows a five-year carryback privilege for an NOL that arises in a tax year beginning in 2018 through 2020. So, you can carry an NOL from one of those years back to an earlier year, deduct it, and recover some or all the federal income tax paid for the carryback year. Because federal income tax rates were generally higher in years before the TCJA took effect, NOLs carried back to those years can be especially beneficial.

For More Information

The economic fallout from the COVID-19 crisis increases the odds that your rental properties will incur losses in 2020, but special tax relief provisions may soften the blow. If you have questions or want more information, consult your tax professional.

QBI Deductions for Rental Properties

Many rental properties are owned by so-called “pass-through” entities, such as sole proprietorships, limited liability companies (LLCs) treated as sole proprietorships for tax purposes, partnerships, LLCs treated as partnerships for tax purposes and S corporations. Your share of net income from a pass-through entity is passed through to you and reported on your personal return.

For 2018 through 2025, the Tax Cuts and Jobs Act (TCJA) established a new personal deduction based on qualified business income (QBI) from a pass-through entity. The deduction can be up to 20% of QBI, subject to restrictions that can apply at higher income levels.

Last year, the IRS set forth a safe-harbor provision that allows QBI deductions based on net income generated by eligible rental property activities that are owned via pass-through entities. Many rental property activities will be eligible for the safe-harbor provision, but some complicated rules must be followed. Consult your tax advisor for more information.